This story is part of a series about housing affordability in Hampton Roads produced in partnership with the Pulitzer Center on Crisis Reporting.

Jenna Stevens dreamed of giving her children what she didn’t have as a military kid: One home for all four years of high school.

“Every time I rent a home, it feels further and further from what I really want for my kids,” said Stevens, a single parent. Her 15-year-old daughter is growing up fast. “I have this nostalgic feeling, I’d like her to drive by her family home or bring her family home to say ‘This is where I grew up. This was my room when I was a kid.’”

“She’s not going to be able to do that, and I’m angry about that.”

Stevens, who is self-employed and runs an online resale store, has dealt with her share of problems as a renter. She doesn’t think owning a home, especially in the Virginia Beach school district where she lives, will happen any time soon.

Fifty percent of people who responded to a monthly survey by mortgage provider Fannie Mae share Stevens’ concern – they think they would have a difficult time getting a mortgage.

Despite that, 75% of us still consider it the most important piece to achieving the increasingly elusive American Dream.

“A lot of people just have it as a simple goal,” said Mel Jones, associate director of the Housing Research Center at Virginia Tech. The center creates reports for localities and regions in the state, including a 2017 report for Virginia Beach.

“They view homeownership as part of their long-term success,” she said.

The concept of the American Dream is also rooted in freedom and security for many people, said Neil McCullagh who studies home ownership at Boston College’s Joseph E. Corcoran Center for Real Estate and Urban Action.

“Your home is a place of refuge … of personal safety, where you can recharge to go out into the world and become productive, where you can become educated, where you can build your capital,” he said.

“When you have your own home, you can put down roots. You can become a stronger part of the community.”

In Hampton Roads, more people rent than own their homes. Many are struggling.

Roughly 54% of renters in Hampton Roads are burdened by the cost of their housing, according to an analysis of home prices and U.S. Census data. A person is considered cost-burdened if they spend more than 30% of their income on rent or mortgage.

About 28% of homeowners in Hampton Roads are cost-burdened.

Data shows a monthly mortgage payment is likely a smaller percentage of someone’s income than rent could be.

Stevens feels the financial pinch. To rent a home in the Kings Grant neighborhood big enough for her and her four kids, she’d likely pay close to $2,000 a month, she said.

“How am I going to buy a house unless I win some lottery? I’m not a trust fund kid … my parents didn’t come from money,” she said. “It’s hard. It’s kind of bleak.”

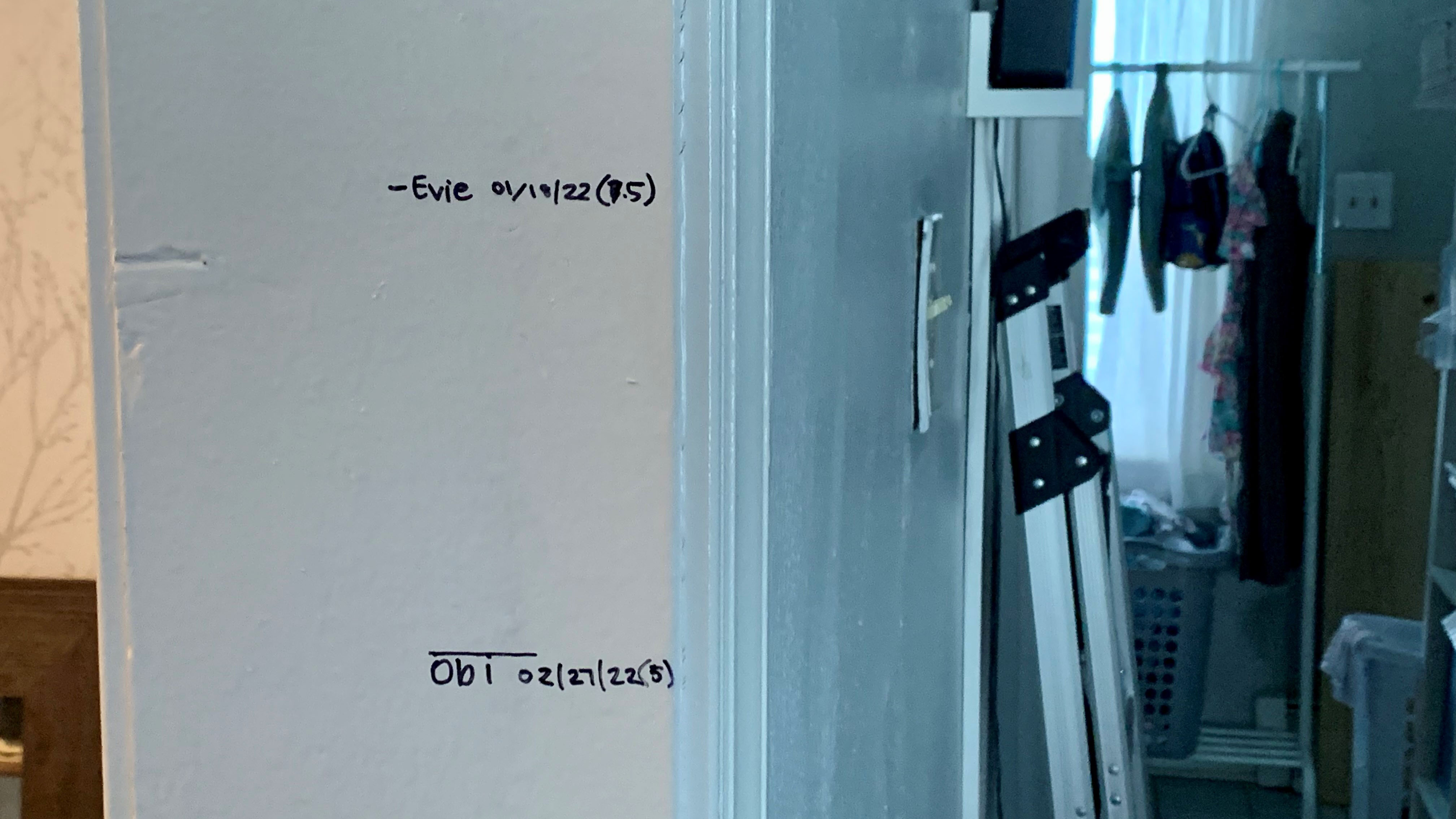

Jenna Stevens in Virginia Beach records her children's heights in all the homes they move to. She and her four kids are moving to Chesapeake, where she says they'll start the tradition over in their new home.

Owning a home is the main way Americans build wealth.

In Hampton Roads, the average mortgage payment is about $1,600. Median rent for a two-bedroom home is slightly less, around $1,400. Renters spend more of their money on housing than homeowners.

Nationally, most renters in recent decades have had less than $400 in the bank, according to a study by the Pew Charitable Trust. Meanwhile, half of surveyed homeowners had about $7,000.

“They also have the choice to use that home as a tool to do other things, to borrow against it, to create education opportunities for families, to invest in a small business, to buy a car, whatever it is,” McCullagh said.

Stevens knows her family’s finances - and lives - would be different if she could find an affordable home to buy.

“People will say ‘money doesn’t buy happiness,” Stevens said. “(But) money buys stability and stability can lead to joy. And that's all I really want. I just want my kids to have a stable home and some joy.”